September 2025

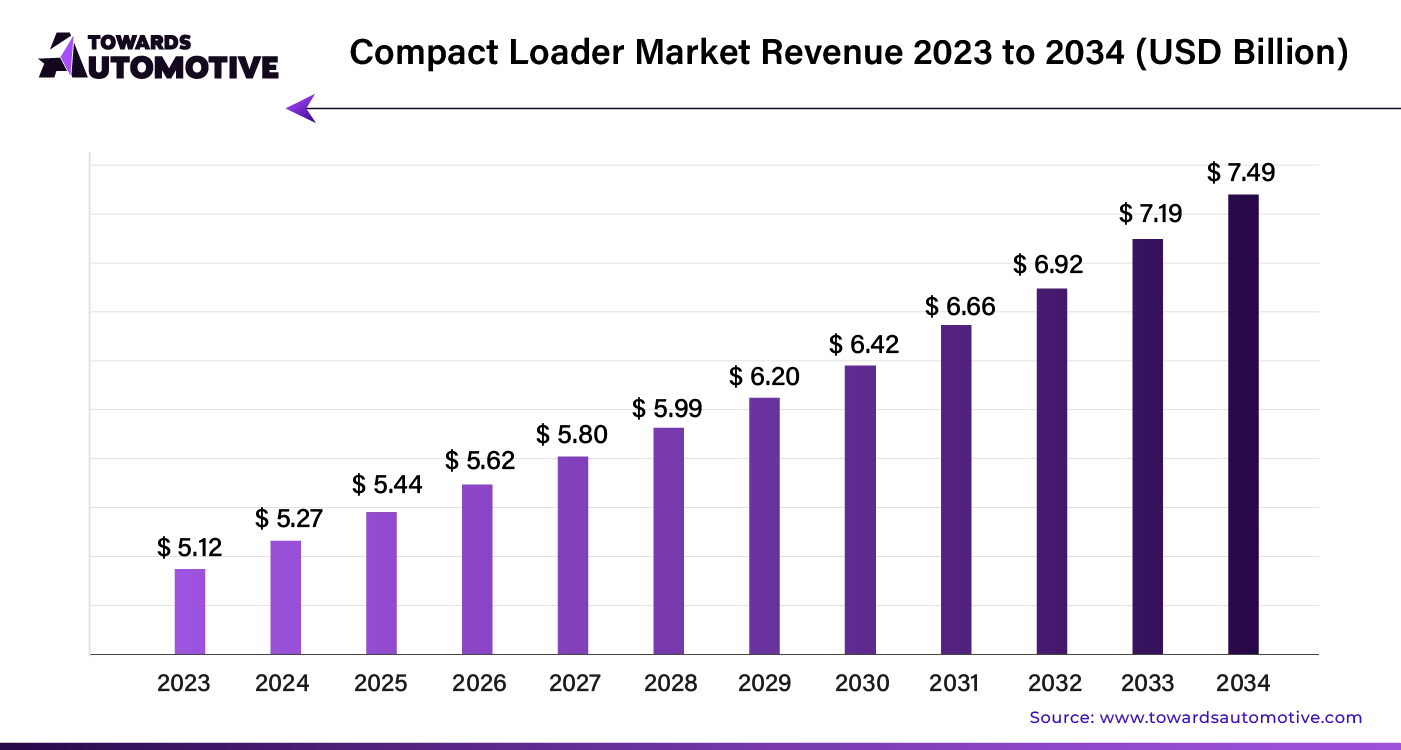

The compact loader market is forecast to grow from USD 5.44 billion in 2025 to USD 7.49 billion by 2034, driven by a CAGR of 3.13% from 2025 to 2034. The growing demand for advanced machineries in the construction sector coupled with rise in number of residential constructions in developed nations has contributed to the market expansion.

Additionally, the increasing adoption of electrically-powered compact loaders in the mining sector along with numerous government initiatives aimed at lowering industrial emission is playing a vital role in shaping the industrial landscape. The research and development related to hybrid loaders is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The compact loader market is a crucial sector of the automotive industry. This industry deals in development and distribution of compact loading equipment in different parts of the world. There are several types of products developed in this sector consisting of wheel loader and track loader. These loaders are powered by numerous sources including diesel, electric, hybrid and others. It finds application in various industries comprising of construction, landscaping, agriculture, forestry and some others. This market is expected to rise significantly with the growth of the mining sector around the globe.

The major trends in this market consists of partnerships, popularity of landscaping and government regulations.

The wheel loader segment dominated the market. The increasing use of wheel loaders for material handling tasks such as loading, carrying, and movement of materials has boosted the market expansion. Additionally, the growing application of these machineries in the farming sector and construction sites is playing a vital role in shaping the industrial landscape. Moreover, the rising demand for heavy-duty wheel loaders from the mining sector is expected to boost the growth of the compact loader market.

The track loader segment is expected to grow with a considerable CAGR during the forecast period. The rising adoption of track loaders in the landscaping sector for operating several tasks such as land clearing, material handling, grading, digging and some others has driven the market growth. Additionally, numerous advantages of compact loaders including superior traction & stability, reduced ground pressure, increased efficiency, versatility and some others is expected to foster the growth of the compact loader market.

The electric segment held the largest share of the market. The growing adoption of electric equipment in the mining sector to reduce vehicular emission has driven the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid investment by battery companies to develop high-quality batteries for electric loaders is contributing to the industry in a positive manner. Moreover, partnerships among construction companies and market players to deploy electric loaders in construction sites is expected to boost the growth of the compact loader market.

The diesel segment is expected to rise with a notable CAGR during the forecast period. The increasing demand for powerful machineries in heavy industries has boosted the market growth. Additionally, lack of well-defined charging infrastructure in underdeveloped countries coupled with rapid focus of equipment manufacturers on developing diesel-powered compact loaders is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of these loaders including improved fuel efficiency, greater torque, longer engine life and some others is expected to foster the growth of the compact loader market.

The construction segment dominated the industry. The rise in number of residential constructions in various countries such as India, China, the U.S., Canada and some others has driven the market growth. Additionally, rapid investment by government for developing the road infrastructure coupled with partnerships among real-estate companies and compact loader companies is playing a vital role in shaping the industrial landscape. Moreover, the growing adoption of electric loaders in the construction sector is expected to foster the growth of the compact loader market.

The mining segment is expected to grow with a robust CAGR during the forecast period. The rise in number of gold mines in several mines such as Russia, the U.S., Canada and some others has driven the market growth. Also, numerous government initiatives aimed at developing the mining sector along with rapid adoption of hybrid loaders in coal mines is contributing to the industry in a positive manner. Moreover, collaborations among equipment providers and mine operators is expected to boost the growth of the compact loader market.

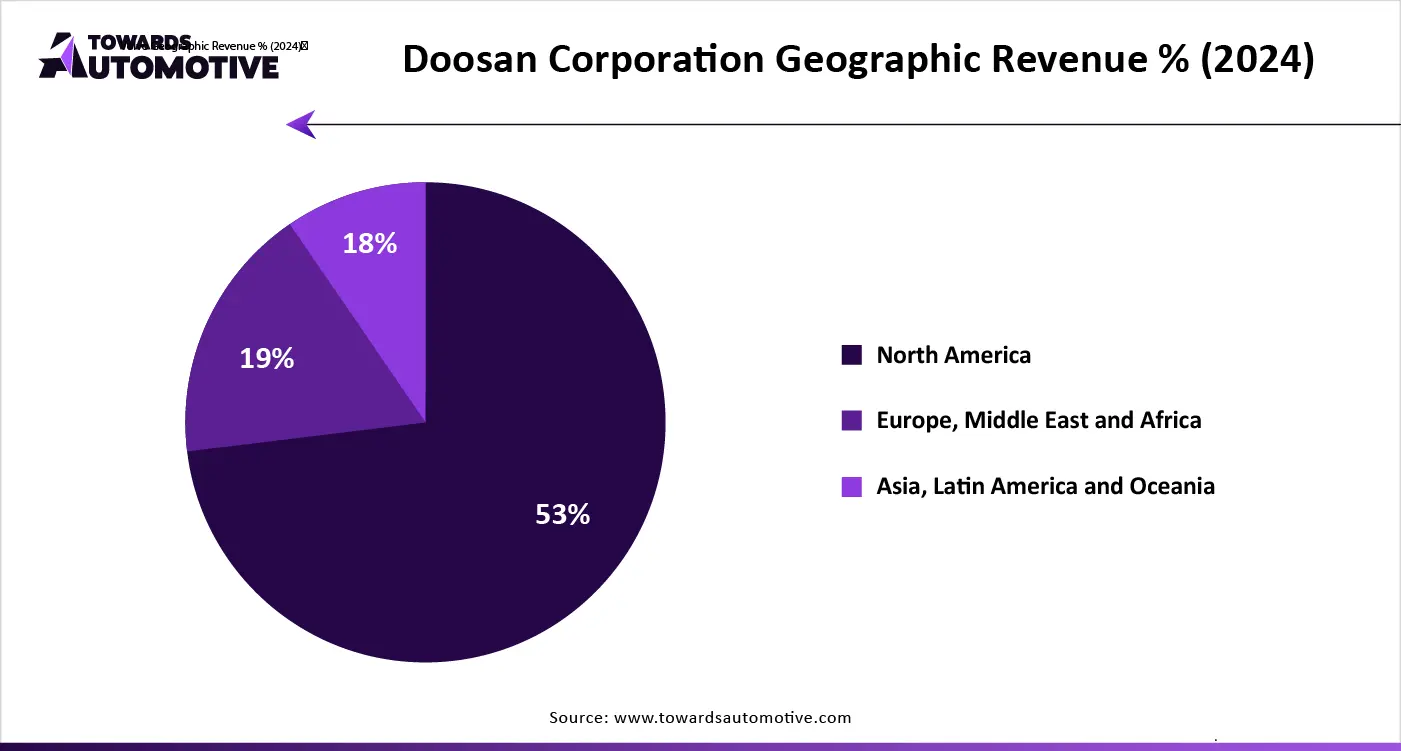

North America dominated the compact loader market. The growing adoption of electric machineries in the U.S. and Canada has boosted the market expansion. Additionally, rapid investment by government for developing the mining sector coupled with rise in number of residential buildings is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Caterpillar, Deere & Company, ASV, Bobcat and some others is accelerating the growth of the compact loader market in this region.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The rising demand for hybrid compact loaders in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Additionally, numerous government initiatives aimed at lowering industrial emission along with technological advancements in the mining industry is contributing to the industry in a positive direction. Moreover, the presence of several market players such as Komatsu Ltd., Yanmar Holdings Co. Ltd., Takeuchi Mfg. Co. Ltd. and some others is expected to boost the growth of the compact loader market in this region.

The compact loader market is a rapidly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of KUBOTA Corporation, CNH Industrial N.V., Wacker Neuson Group, Volvo Construction Equipment, Doosan Corporation, Komatsu Ltd., Deere & Company, Caterpillar Inc, Xuzhou Construction Machinery Group Co. Ltd., Hitachi Construction Machinery Co. Ltd., Sany Heavy Industry Co., Ltd., Yanmar Holding Co. Ltd., Liebherr Group, Takeuchi Mfg. Co, Ltd and some others. These companies are constantly engaged in developing compact loaders and adopting numerous strategies such as partnerships, launches, collaborations, acquisitions, business expansions, joint ventures and some others to maintain their dominance in this industry.

By Product Type

By Source Type

By Application

By Region

September 2025

September 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us