August 2025

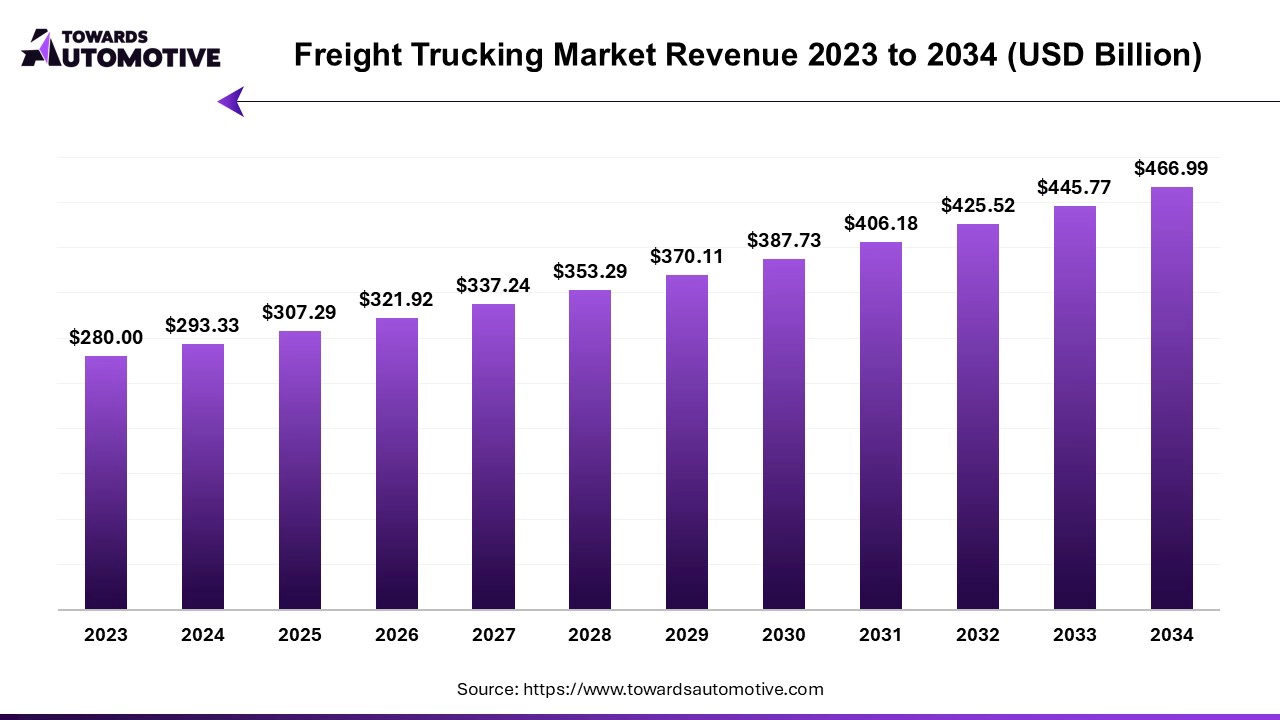

The freight trucking market is expected to increase from USD 307.29 billion in 2025 to USD 466.99 billion by 2034, growing at a CAGR of 4.76% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The freight trucking market is a prominent branch of the automotive industry. This industry deals in transporting goods using heavy-duty trucks. There are numerous types of trucks used in this sector including refrigerated trucks, tankers, dry van, flatbed and some others. The end-user of these trucks consists of various industries comprising of automobiles, machinery, apparels & footwears, pharmaceutical products, retail, electronics, petrochemicals, agriculture, building materials and some others. This market is expected to grow significantly with the rise of the logistics sector around the globe.

The major trends in this market consists of rapid adoption of electric trucks, partnerships and ongoing developments in driverless trucks.

Rapid Adoption of Electric Trucks

The adoption of electric trucks has increased in various industries such as e-commerce, food and beverage, logistics, construction and some others with an aim to reduce emission. For instance, in May 2025, Kenworth launched a new range of electric trucks. This new range of electric trucks are designed for numerous industries across the North America region. (Source: Chargedevs)

Partnerships

Several logistics brands are partnering with trucking companies to enhance freight transportation in different parts of the world. For instance, in January 2025, Freightwise partnered with Estes. This partnership is done for deliver advanced freight trucking services in North America. (Source: Pymnts)

Ongoing Developments in Driverless Trucks

The automotive brands are constantly engaged in developing autonomous trucks for enhancing logistics operations. For instance, in February 2025, Volvo Autonomous Solutions (V.A.S.) announced partnership with Waabi. This partnership is done for launching an autonomous freight trucking service to enhance safety and reducing dependency on drivers. (Source: Volvo Autonomous Solutions)

The dry van segment led the highest share of this industry. The demand for dry van has increased rapidly for transporting non-perishable goods to different parts of the world, thereby driving the market growth. Also, the growing adoption of these vehicles in automotive sector for carrying motorbikes and cars is further adding to the industrial expansion. Moreover, rapid investment by truck companies to develop fuel-efficient dry vans for operating heavy-duty logistics is expected to propel the growth of the freight trucking market.

The tanker segment is expected to grow with the highest CAGR during the forecast period. The demand for tankers has increased rapidly in the oil and gas industry in various countries such as Russia, UAE, China and some others, thereby driving the market growth. Also, the surge in demand for water tankers in isolated areas to deliver healthy water along with the rising application of tanker trucks in milk processing industry is playing a vital role in shaping the industrial landscape. Moreover, the growing research and development activities related to hydrogen-powered tanker trucks is expected to drive the growth of the freight trucking market.

The agriculture segment dominated the freight trucking market. The growing adoption of electric trucks in the agricultural sector for reducing emission has driven the market growth. Also, rapid investment by government for developing the agricultural sector is playing a vital role in shaping the industrial landscape. Moreover, partnerships among market players to launch new freight trucking services for transporting agricultural items is expected to propel the growth of the freight trucking market.

The retail segment is expected to grow with the highest CAGR during the forecast period. The rising demand for heavy-duty trucks for transporting retail goods in different parts of the world has boosted the market expansion. Moreover, the rapid deployment of hydrogen trucks by logistics providers to cater the needs of the retail sector is expected to foster the growth of the freight trucking market.

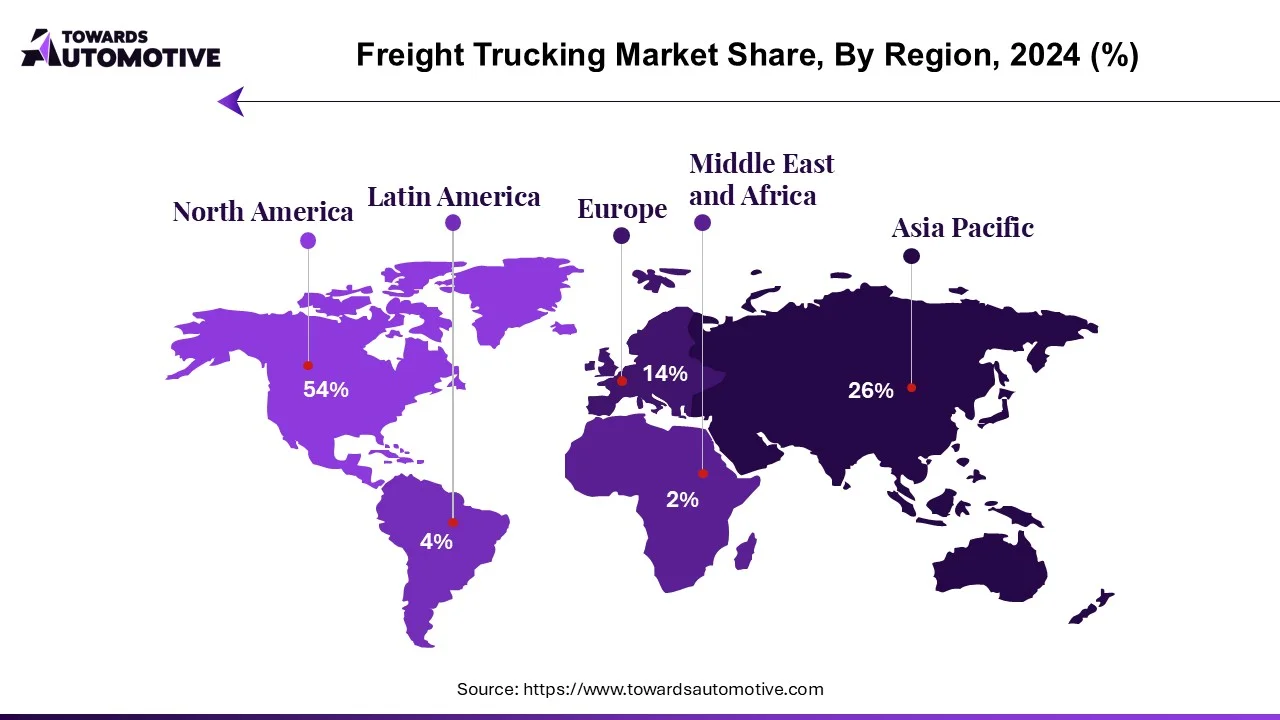

North America dominated the freight trucking market. The growing application of refrigerated trucks in food and beverage industry for transporting perishable items such as processed foods, meat, dairy items, baked goods and some others is expected to drive the market expansion. Additionally, the rising adoption of hydrogen trucks in petrochemicals sector coupled with numerous government initiatives aimed at reducing emission is further adding to the industrial growth. Moreover, the presence of several market players such as C.H. Robinson Worldwide Inc., XPO Logistics, United Parcel Service, Inc., FedEx Corporation and some others is expected to boost the growth of the freight trucking market in this region.

U.S. dominated the market in this region. The growing adoption of hybrid trucks in several e-commerce companies such as Amazon, Walmart, Ebay and some others has contributed to the industrial expansion. Additionally, the presence of several logistics brands coupled with the rising demand for refrigerated trucks has boosted the market growth.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The growing adoption of electric trucks in several industries such as e-commerce, construction, logistics and some others has driven the market growth. Also, various government initiatives aimed at developing the agricultural sector in several countries such as China and India is contributing significantly to the overall industrial expansion. Moreover, the presence of numerous freight trucking companies such as Nippon Express Holdings, Inc., SF Express, SG Holdings Co., Ltd, Scan Global Logistics and some others is expected to drive the growth of the freight trucking market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the rapid development in the electronics industry due to presence of several companies such as Xiaomi, Haier, Hisense, BOE, ZTE and some others along with rapid deployment of autonomous trucks in heavy-duty industries. In India, the growing adoption of electric trucks in several sectors including pharmaceutical and construction has driven the market growth. Additionally, the rising sales of flatbed trailers coupled with numerous government initiatives aimed at developing the agricultural sector is further adding to the industrial expansion.

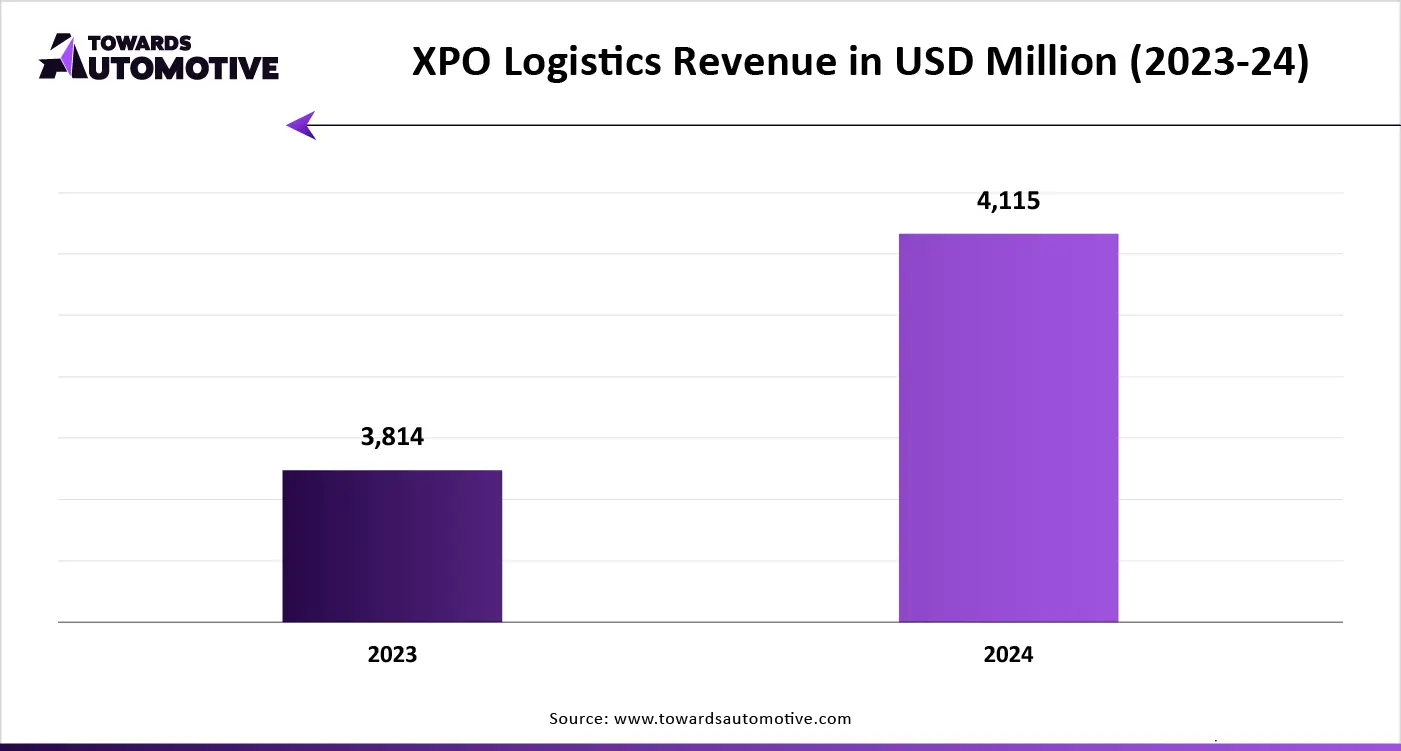

The freight trucking market is a rapidly developing industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of XPO Logistics (U.S.), CEVA Logistics (Switzerland), CMA CGM S.A. (France), Yellow Corporation (U.S.), Estes Express Lines (U.S.), Kuehne + Nagel International AG (Germany), Nippon Express Co., Ltd. (Japan), Saia Inc. (U.S.), SNCF group (France), ArcBest (U.S.) and some others. These companies are constantly engaged in providing trucking services to different end-users and adopting numerous strategies such as business expansions, partnerships, launches, joint ventures, acquisitions, collaborations, and some others to maintain their dominance in this industry.

By Truck Type

By End-User

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us