September 2025

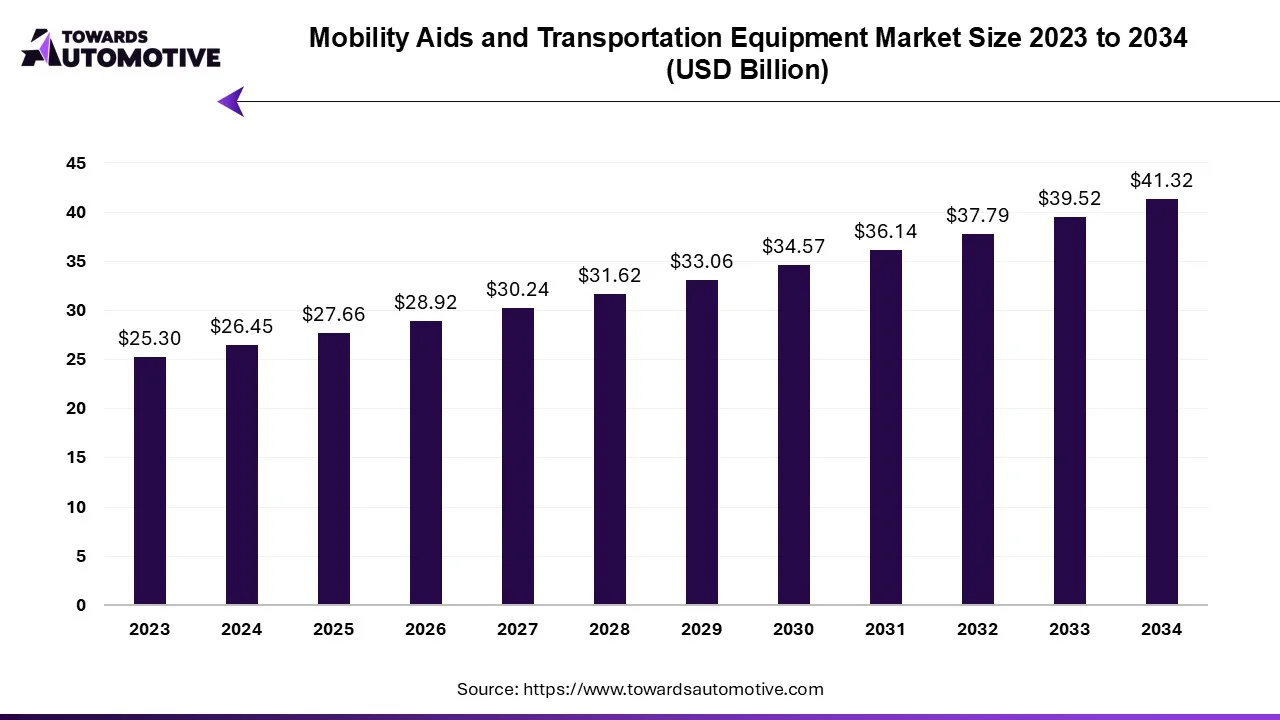

The mobility aids and transportation equipment market is forecast to grow from USD 27.55 billion in 2025 to USD 41.32 billion by 2034, driven by a CAGR of 4.56% from 2025 to 2034. The rising incidences of bone-related diseases such as arthritis, osteomyelitis and others coupled with increase in number of road accidents in different regions has driven the market expansion.

Additionally, the integration of advanced technologies such as AI and IoT in wheelchairs along with numerous government initiatives aimed at supporting physically disabled people is further contributing to the industrial growth. The increasing emphasis on developing electrically-powered mobility aids is expected to create numerous growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The mobility aids and transportation equipment market is a prominent branch of the healthcare industry. This industry deals in manufacturing and distribution of mobility aids in different parts of the world. There are several types of equipment developed in this sector comprising of wheelchairs, scooters, walking aids, stair lifts and some others. These equipment are available in a well-established distribution channel comprising of online retail, medical supply stores, pharmacies, direct sales and some others. The end-users of this sector consists of hospitals, home care, elderly care facilities, rehabilitation centers and some others. This industry is expected to grow significantly with the rise of the medical equipment sector across the globe.

| Metric | Details |

| Market Size in 2024 | USD 26.45 Billion |

| Projected Market Size in 2034 | USD 41.32 Billion |

| CAGR (2025 - 2034) | 4.56% |

| Leading Region | North America |

| Market Segmentation | By Type, By End Use, By Distribution Channel, By User Demographics and By Region |

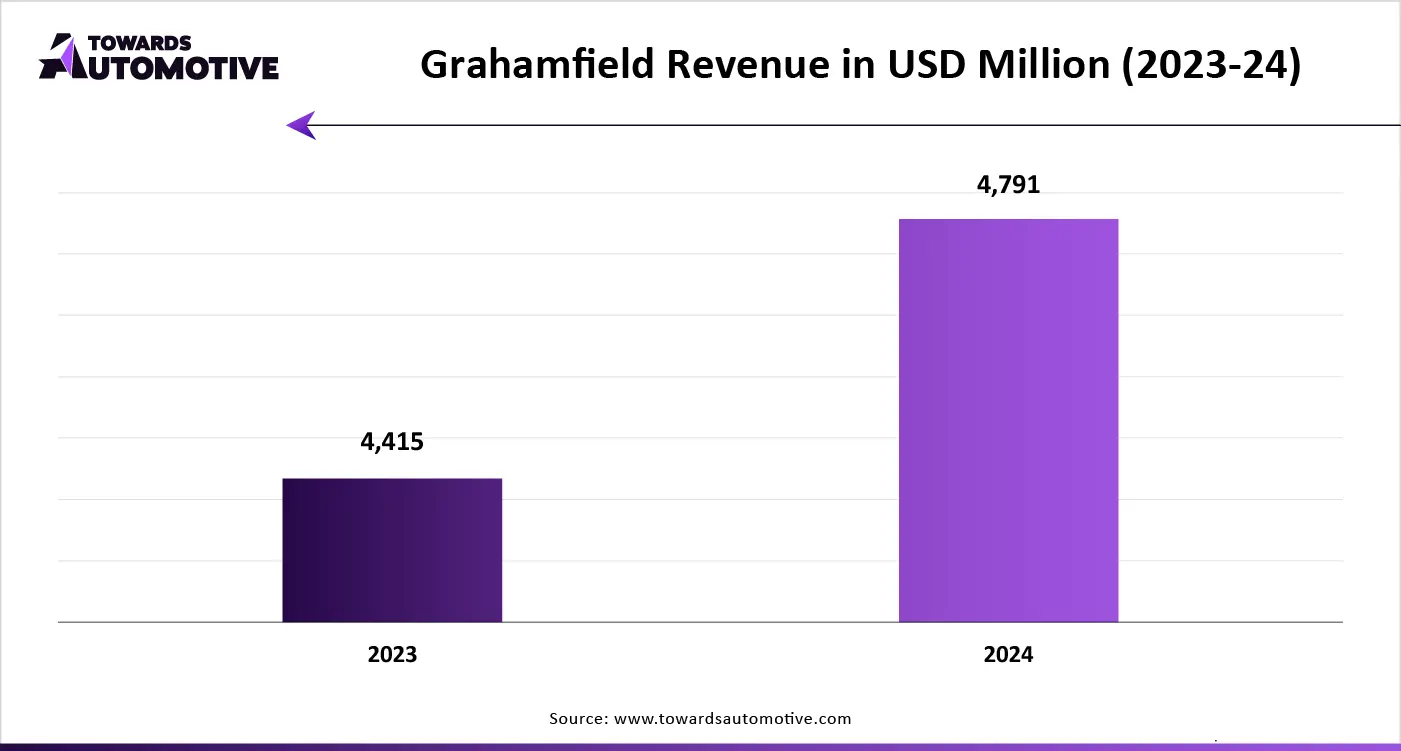

| Top Key Players | Medline Industries, Permobil AB, Handicare, Hudsontel, Invacare Corporation, GrahamField Healthcare, Karma Mobility, Harmar Mobility |

The major trends in this market consists of government initiatives, rise in number of handicapped people and technological advancements in healthcare equipment.

Numerous government initiatives aimed at providing mobility aids to physically challenged people has helped the industry to rise significantly.

With the rise in number of handicapped people, the demand for superior-quality mobility aids is increasing rapidly in recent times.

The integration of advanced technologies such as AI and IoT in healthcare equipment has attracted numerous consumers to enhance mobility of handicapped people.

The wheelchairs segment led the market. The rising adoption of electrically-powered wheel chairs in modern hospitals to transport patients from their rooms to chambers has driven the market expansion. Additionally, numerous government initiatives aimed at providing wheelchairs to handicapped people coupled with rising cases of road accidents in different parts of the world is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by market players for developing advanced wheel chairs is expected to propel the growth of the mobility aids and transportation equipment market.

The scooters segment is expected to expand with a significant CAGR during the forecast period. The rising demand for handicapped scooters in developed nations has boosted the market expansion. Also, rapid investment by market players for developing electrically-powered handicapped scooters coupled with increased fundings by NGOs for distributing scooters to the physically disabled people is contributing to the industrial growth. Moreover, integration of advanced technologies in handicap scooters is expected to drive the growth of the mobility aids and transportation equipment market.

The online retail segment held the largest share of the market. The rising proliferation of smartphones has enabled people to purchase and sell items in online platforms has boosted the market growth. Additionally, the availability of numerous types of mobility aids in various online platforms such as Ebay, Alibaba, Amazon and some others is playing a vital role in shaping the industrial landscape. Moreover, rapid growth of the e-commerce sector in the U.S., India, Canada and some others is expected to drive the growth of the mobility aids and transportation equipment market.

The pharmacies segment is expected to grow with a considerable CAGR during the forecast period. The rising consumer preference to visit pharmacies for purchasing mobility aids has boosted the market expansion. Also, rapid investment by hospitals to construct pharmacies in their compound is expected to propel the growth of the mobility aids and transportation equipment market.

North America led the mobility aids and transportation equipment market. The growing demand for technologically advanced wheelchairs and walking aids from the old-age population of the U.S. and Canada has driven the market expansion. Also, rising focus of market players to open new outlets coupled with rapid investment by government for developing the healthcare infrastructure is further adding to the industrial growth. Moreover, the presence of several market players such as Invacare Corporation, Harmar Mobility, Pride Mobility and some others is expected to propel the growth of the mobility aids and transportation equipment market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The rise in number of government hospitals in several countries such as India, Japan, China and some others has driven the market growth. Additionally, numerous government initiatives aimed at providing advanced mobility aids to physically challenged individuals coupled with proliferation of new healthcare startups is contributing to the industrial expansion. Moreover, the presence of numerous market players such as Karma Medical, Kaiyang Medical, Frido, Matsunaga and some others is expected to drive the growth of the mobility aids and transportation equipment market in this region.

The mobility aids and transportation equipment market is a highly competitive industry with the presence of various dominating players. Some of the prominent companies in this industry consists of Medline Industries, Permobil AB, Handicare, Hudsontel, Invacare Corporation, GrahamField Healthcare, Karma Mobility, Harmar Mobility, Reach Mobility, Golden Technologies, Drive DeVilbiss Healthcare, Ottobock, Sunrise Medical, Pride Mobility Products, Eigen Healthcare and some others. These companies are constantly engaged in developing mobility aids and transportation equipment and adopting numerous strategies such as joint ventures, launches, business expansions, acquisitions, partnerships, collaborations and some others to maintain their dominance in this industry.

By Type

By End Use

By Distribution Channel

By User Demographics

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us