December 2025

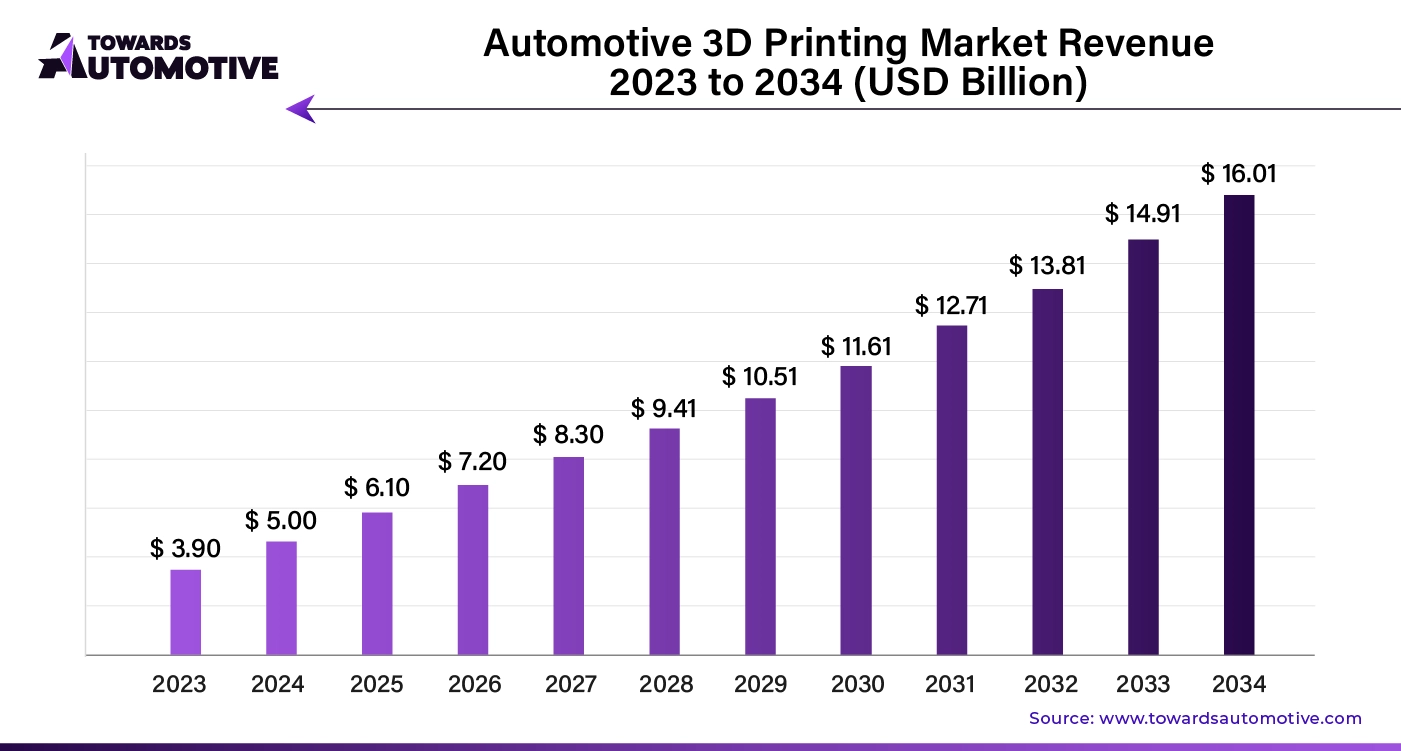

The automotive 3D printing market is set to rise from USD 6.10 billion in 2025 to USD 16.01 billion by 2034 at a 19.40% CAGR. The study quantifies demand by offering (hardware, software, services), type (SLA, SLS, FDM, EBM, DLP, others), material (metal, polymer, ceramic), component (interior, exterior), and application (prototyping, tooling, production, others). It benchmarks North America as the current leader and sizes APAC as the fastest-growing region, with full splits for Europe, Latin America, and MEA. Competitive analysis covers Stratasys, 3D Systems, EOS, SLM Solutions, Desktop Metal, Materialise, Voxeljet, Nexa3D, Ultimaker, EnvisionTEC, Autodesk, ExOne, etc., alongside market shares, product breadth, and pricing tiers. We map the value chain from powders/filaments and printer hardware to software, integrators, and OEMs; include trade flows (imports/exports of printers, powders, and parts); and profile manufacturers & suppliers with 2024–2025 EBITDA bands, utilization rates, and capex intentions.

The automotive 3D printing market is rapidly transforming the automotive industry by offering new ways to design, prototype, and manufacture parts with greater efficiency and customization. 3D printing, also known as additive manufacturing, enables automakers to reduce development time and production costs while improving precision and material usage. This technology is especially valuable for producing complex components, lightweight parts, and limited-run customizations, which are increasingly demanded by both manufacturers and consumers.

Key applications of 3D printing in the automotive sector include prototyping, tooling, and the production of final parts. By enabling rapid prototyping, 3D printing allows manufacturers to test designs and functionalities in a shorter time, reducing the traditional timelines for product development. This is critical for the automotive industry, where speed and innovation are essential to maintain a competitive edge. Furthermore, the technology supports the creation of complex geometries that would be difficult or impossible to produce with traditional manufacturing methods, allowing for more optimized and lightweight designs, which contribute to the growing focus on sustainability and fuel efficiency.

Additionally, the customization capabilities of 3D printing are unlocking new opportunities for personalized vehicle components, from aesthetic enhancements to tailored performance parts. As electric vehicles (EVs) and autonomous vehicles (AVs) gain prominence, the demand for lighter, more efficient, and adaptable components is driving the adoption of 3D printing in automotive manufacturing. With advancements in materials, such as metal and composite printing, and improvements in scalability, the market is poised for robust growth in the coming years.

In this rapidly evolving landscape, the Automotive 3D Printing Market is set to play a crucial role in shaping the future of car manufacturing, reducing costs, enhancing customization, and promoting sustainability across the supply chain.

Artificial Intelligence (AI) plays a transformative role in the automotive body-in-white market by enhancing manufacturing efficiency, improving quality control, and optimizing design processes. AI algorithms are employed in the design phase to analyze and optimize the structural integrity and performance of the BIW. AI can simulate various stress and impact scenarios, leading to the development of more robust and lightweight body structures. This results in improved vehicle safety, fuel efficiency, and overall performance.

AI-powered vision systems and machine learning algorithms are used in quality control processes to detect defects and ensure that each BIW meets stringent quality standards. Automated inspection systems can identify even the smallest deviations from specifications, reducing the likelihood of defects and improving the overall quality of the finished vehicle.

AI-driven automation and robotics are increasingly used in BIW production lines to enhance manufacturing efficiency. AI systems optimize the placement and movement of robotic arms, streamline assembly processes, and improve the precision of welds and other critical operations. This leads to increased production rates and reduced manufacturing costs.

AI applications in predictive maintenance analyze data from machinery and equipment to forecast potential failures before they occur. This proactive approach minimizes downtime, reduces maintenance costs, and ensures continuous production flow.

AI helps in managing the complex supply chains involved in BIW production. By analyzing data on material availability, demand, and production schedules, AI systems optimize inventory management and logistics, ensuring that materials are available when needed and reducing delays.

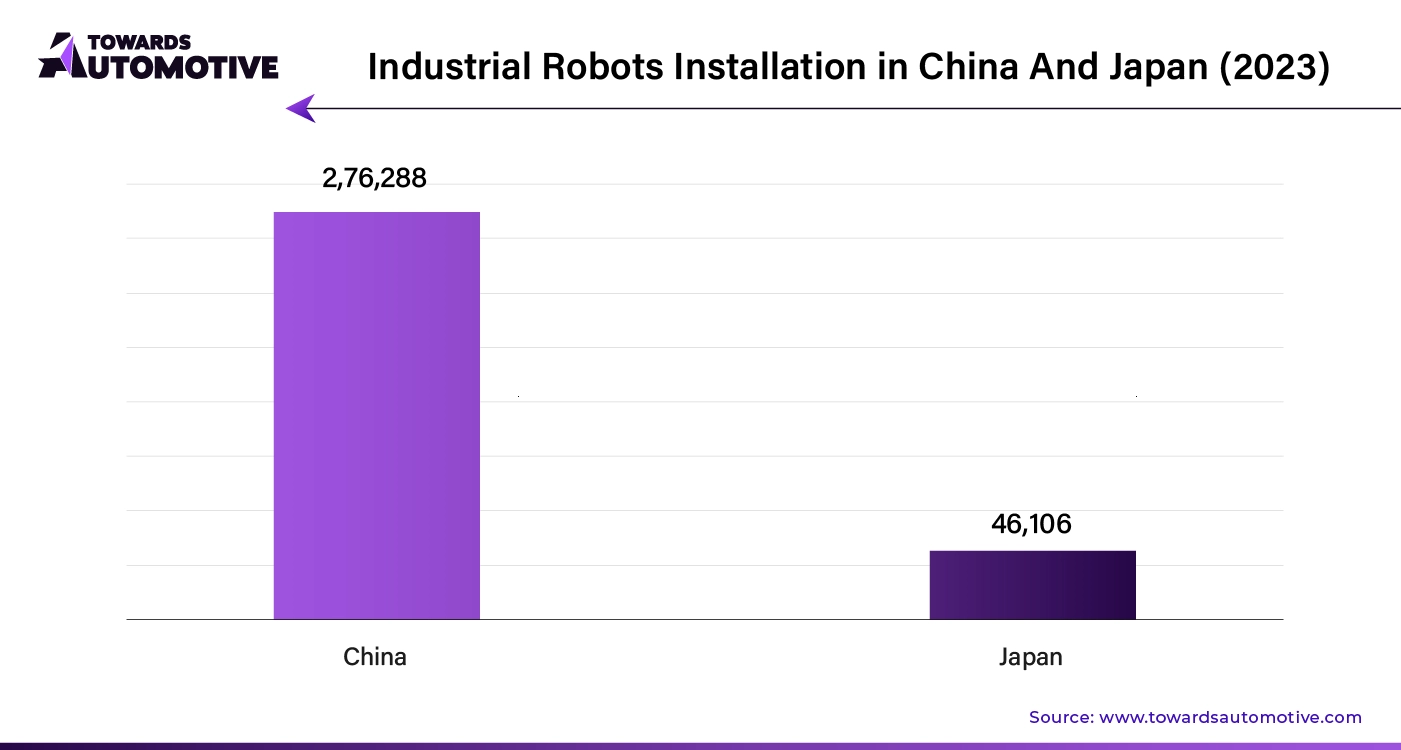

The rising development of robotics is significantly driving the growth of the Automotive 3D Printing Market, as automation and precision become increasingly critical in modern manufacturing. Robotics, when integrated with 3D printing technology, enhances production efficiency by automating complex, labor-intensive processes, reducing human error, and enabling continuous manufacturing. This synergy allows automakers to scale up production while maintaining high precision, especially in creating intricate parts and components that require consistent quality and accuracy. Robotics also supports faster prototyping, streamlining the entire design-to-production cycle, which is vital in the fast-paced automotive sector. As manufacturers push for greater customization, robotics facilitates the production of unique, tailored parts at a faster rate, meeting growing consumer demands for personalized vehicles. Additionally, robotics improves material handling, post-processing, and assembly in 3D printing operations, further boosting productivity and reducing operational costs. As the automotive industry increasingly adopts advanced robotics, the integration with 3D printing technology is set to accelerate market growth, enabling higher production volumes and more innovative designs.

The Automotive 3D Printing Market faces key restraints that limit its growth, including high initial costs for advanced 3D printers and materials, which can deter smaller manufacturers. Additionally, the limited range of compatible materials, particularly for high-performance components, restricts broader application. Scalability challenges also pose concerns, as 3D printing is primarily used for prototyping rather than mass production. Furthermore, the regulatory landscape for certifying 3D-printed automotive parts remains underdeveloped, creating hurdles for integrating this technology into large-scale manufacturing processes.

Multi-material 3D printing is creating significant opportunities in the Automotive 3D Printing Market by enabling the production of complex components with varying properties, all in a single manufacturing process. Unlike traditional 3D printing methods that are often limited to a single material, multi-material 3D printing allows automakers to integrate different materials, such as metals, polymers, and composites, into a single part. This innovation is particularly valuable for producing lightweight yet durable components, which are critical for electric vehicles (EVs) and autonomous vehicles (AVs) where weight reduction directly impacts performance and efficiency.

The ability to combine materials with different mechanical, thermal, or chemical properties opens up possibilities for creating parts with enhanced functionality, such as improved strength, heat resistance, and flexibility. This advancement enables automakers to design and manufacture more sophisticated components that were previously impossible or too costly with traditional methods. Furthermore, multi-material 3D printing supports increased customization, allowing manufacturers to offer personalized parts and features, catering to specific consumer demands. As this technology matures, it is expected to drive innovation, reduce manufacturing costs, and accelerate the adoption of 3D printing in the automotive industry.

The hardware segment held the largest share of the market. The hardware segment is a key driver of growth in the Automotive 3D Printing Market, as advancements in 3D printers and related equipment are enabling more efficient and scalable production processes. The development of next-generation 3D printers with enhanced precision, speed, and material compatibility has significantly expanded the potential applications of additive manufacturing in the automotive sector. These advanced machines can produce highly complex, lightweight parts that improve vehicle performance while reducing material waste, making them particularly valuable for electric vehicles (EVs) and autonomous vehicles (AVs).

One of the primary contributions of the hardware segment is the increasing availability of metal 3D printers, which allow for the production of strong, heat-resistant components that are essential in critical automotive applications, such as engine parts, brake systems, and exhaust components. As these printers become more affordable and accessible, they are driving wider adoption of 3D printing technology across the automotive industry.

Furthermore, the integration of automation and AI-powered hardware solutions is streamlining the additive manufacturing process, enabling faster and more precise production. Automated 3D printers reduce the need for manual intervention, lowering labor costs and increasing productivity, which is crucial for scaling up production in a cost-effective manner.

As hardware innovations continue to evolve, the automotive industry is expected to increasingly leverage 3D printing for prototyping, tooling, and mass production, unlocking new opportunities for customization, improved efficiency, and sustainable manufacturing practices. The ongoing advancements in the hardware segment will continue to drive the growth and adoption of 3D printing technology across the automotive market.

The prototyping segment led the market. The prototyping segment plays a pivotal role in driving the growth of the Automotive 3D Printing Market by significantly enhancing the design and development processes for automakers. Traditionally, automotive prototyping involved time-consuming and expensive methods, often requiring the creation of multiple physical models to test and refine designs. With 3D printing, however, manufacturers can now rapidly produce highly accurate prototypes in a fraction of the time, allowing for quicker iteration and validation of new components. This acceleration in the design cycle not only reduces the time-to-market for new vehicles but also lowers development costs, giving companies a competitive edge in a fast-evolving industry.

One of the key advantages of 3D printing in prototyping is the ability to create complex geometries and detailed parts that were previously difficult or impossible to produce using traditional methods. This capability allows automakers to experiment with innovative designs, optimize component functionality, and test different materials before committing to full-scale production. The flexibility to make real-time design adjustments based on testing results further enhances product development efficiency.

Moreover, 3D printing enables more sustainable prototyping by reducing material waste and energy consumption, aligning with the automotive industry's growing focus on eco-friendly practices. As demand for electric vehicles (EVs) and autonomous vehicles (AVs) rises, the need for faster, more efficient prototyping will continue to increase, positioning the prototyping segment as a key driver in the ongoing growth of the automotive 3D printing market.

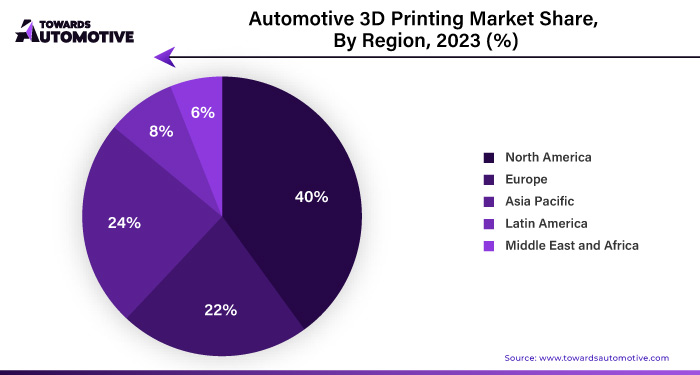

North America dominated the automotive 3D printing market. In North America, the growth of the Automotive 3D Printing Market is significantly driven by a combination of technological advancements, the strong presence of major automotive giants, and the focus on supply chain efficiency and localization. Technological innovations in 3D printing are at the forefront of this growth, with cutting-edge developments in printer capabilities, materials, and software enabling the production of highly complex and customized automotive components. These advancements facilitate rapid prototyping, reduce development cycles, and enhance the production of lightweight, high-performance parts, which are crucial for the evolving demands of electric and autonomous vehicles.

The strong presence of prominent automotive manufacturers in North America, such as Ford, General Motors, and Tesla, further accelerates market growth. These industry leaders are investing heavily in 3D printing technology to streamline their manufacturing processes, enhance design flexibility, and achieve cost efficiencies. Their adoption of 3D printing for both prototyping and production underscores the technology's role in driving innovation and competitiveness within the sector.

Additionally, the emphasis on supply chain efficiency and localization is reshaping the automotive 3D printing landscape. The ability to produce parts on-demand with 3D printing reduces reliance on global supply chains and mitigates risks associated with disruptions. By localizing production, manufacturers can lower inventory costs and respond more quickly to market changes, aligning with the growing need for agile and resilient supply chain solutions. Together, these factors are propelling the growth of the automotive 3D printing market in North America, positioning the region as a leader in advanced manufacturing technologies.

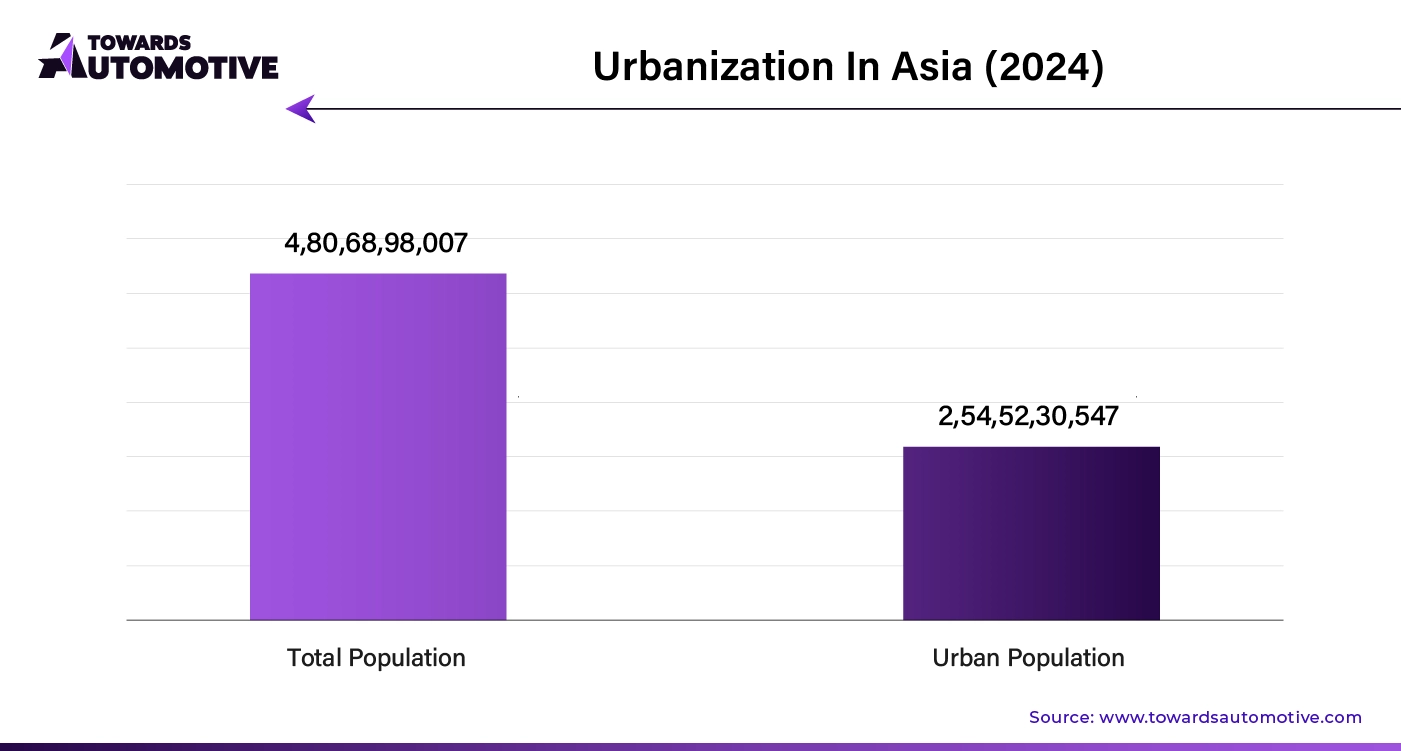

Asia Pacific is expected to grow with the highest CAGR during the forecast period. In Asia Pacific, the Automotive 3D Printing Market is experiencing robust growth driven by urbanization, government investments, and the burgeoning automotive market. Rapid urbanization across the region is significantly impacting the automotive industry by increasing demand for innovative, efficient, and customized vehicle solutions. As cities expand and populations grow, there is a rising need for advanced manufacturing technologies that can cater to the diverse and evolving needs of urban transport. 3D printing addresses these needs by offering flexible and scalable solutions for producing complex and high-performance automotive components that align with the fast-paced development of modern cities.

Government investments and initiatives also play a crucial role in driving market growth. Governments across Asia Pacific are actively supporting advanced manufacturing technologies, including 3D printing, through subsidies, grants, and research and development programs. These investments are designed to boost technological adoption and innovation, helping the automotive industry to enhance production capabilities, reduce costs, and improve competitiveness on a global scale.

Furthermore, the growing automotive market in Asia Pacific, driven by rising disposable incomes and increasing vehicle ownership, creates significant opportunities for 3D printing technology. Automakers in the region are leveraging 3D printing to meet the demand for more customized and cost-effective components, accelerate product development, and streamline production processes. This alignment with market needs positions 3D printing as a vital technology for meeting the region’s automotive demands and driving sustained market growth.

By Offering

By Type

By Material

By Component

By Application

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us