August 2025

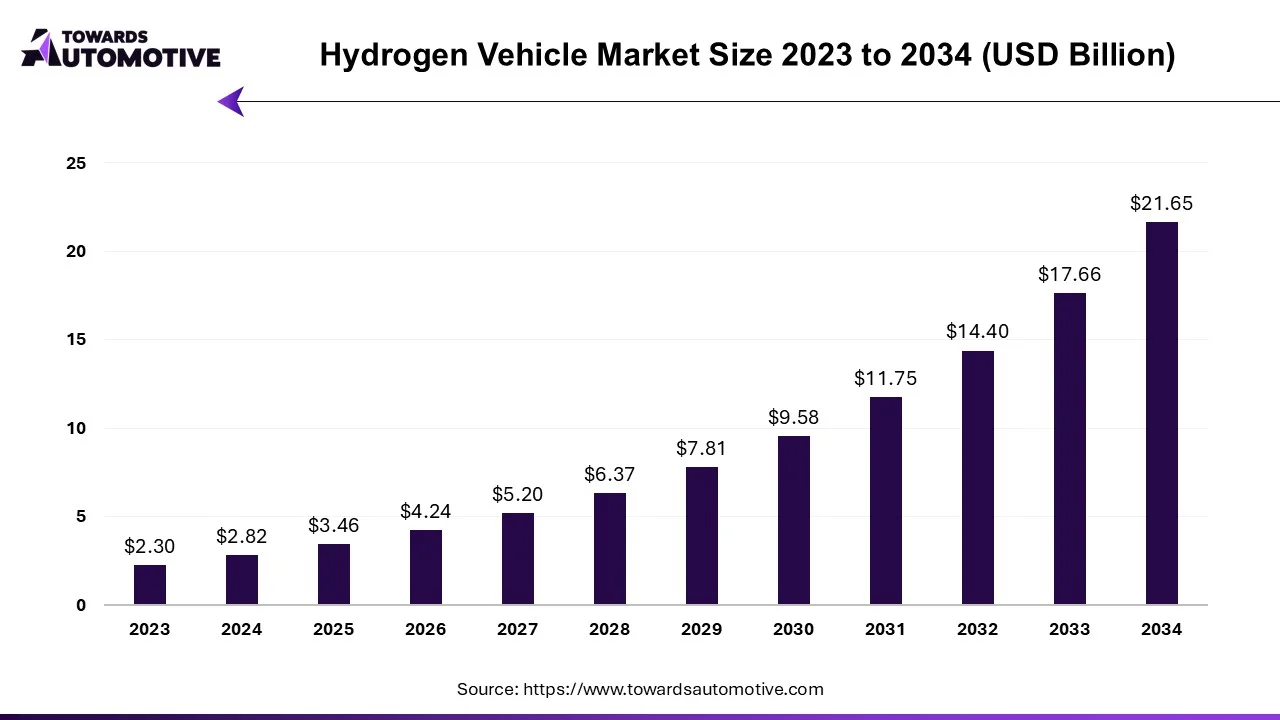

The hydrogen vehicle market is projected to reach USD 21.65 billion by 2034, expanding from USD 3.46 billion in 2025, at an annual growth rate of 22.61% during the forecast period from 2025 to 2034. The rising demand for eco-friendly vehicles in different parts of the world coupled with technological advancements related to hydrogen vehicles is playing a vital role in shaping the industry in a positive direction.

Additionally, the rise in number hydrogen refueling stations along with numerous government initiatives aimed at developing the hydrogen infrastructure has contributed to the industrial expansion. The increasing emphasis of automotive brands for developing H2-ICE engines to power heavy-duty vehicles is expected to create ample growth opportunities for the market players in the upcoming years.

Unlock Infinite Advantages: Subscribe to Annual Membership

The hydrogen vehicle market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of hydrogen vehicles in different parts of the world. There are different types of vehicles developed in this sector comprising of passenger cars and commercial vehicles. These vehicles are integrated with numerous technologies consisting of alkaline fuel cells, proton exchange membrane fuel cell, phosphoric acid fuel cell, solid oxide fuel cell and some others. It finds application in various sectors including private, commercial, public transport, industrial and some others. The rapid investment by automotive brands for developing hydrogen cars has contributed to the market growth. This market is expected to grow significantly with the rise of the chemicals industry around the globe.

The trends in this industry comprises of government investment, partnerships and launches of FCEVs.

Government of several countries such as India, UK, France, UAE and some others are investing heavily for developing the hydrogen infrastructure. For instance, in June 2025, the government of UK announced to invest around 500 million euros. This investment is done for developing the EV infrastructure across this nation.(Source: Fuelcellsworks)

Several commercial vehicle manufacturers are partnering with trucking companies for developing FCEV truck to operate daily activities. For instance, in April 2025, Savage partnered with Symbio North America. This partnership is done for deploying Symbio’s hydrogen trucks in the drayage operations across the U.S.(Source: Fuelcellsworks)

Numerous market players are constantly engaged in developing and launching new FCEVs to cater the needs of the eco-friendly consumers across the world.

The passenger cars segment dominated the market. The growing demand for eco-friendly sedans in several countries such as India, Japan, the U.S., France and some others has boosted the market expansion. Additionally, rising consumer awareness for reducing C02 emission coupled with rapid investment by automotive brands to manufacture hydrogen powertrains for passenger cars is playing a vital role in shaping the industry in a positive direction. Moreover, collaborations among automotive brands and engine manufacturers to develop heavy-duty engines is expected to drive the growth of the hydrogen vehicle market.

The commercial vehicles segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of hydrogen trucks in several industries such as e-commerce, logistics, mining, and some others has boosted the market growth. Additionally, numerous government initiatives aimed at deploying hydrogen buses to provide sustainable transportation solutions in several nations is contributing to the industrial expansion. Moreover, rapid investment by commercial vehicle companies for opening up new manufacturing facilities to enhance the production of hydrogen-based commercial vehicles is expected to propel the growth of the hydrogen vehicle market.

The 0-250 miles segment is the major contributor of the market. The growing demand for hydrogen-powered luxury vehicles in several countries such as the U.S., Germany, Saudi Arabia and some others has boosted the market expansion. Additionally, the rising investment by engine manufacturers to develop low-maintenance hydrogen cells coupled with rapid adoption of hydrogen cars by fleet operators to facilitate daily commutes is playing a vital role in shaping the industrial landscape. Moreover, partnerships among prominent automotive brands to develop hydrogen cars is expected to boost the growth of the hydrogen vehicle market.

The above 500 miles segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of heavy-duty hydrogen trucks in the e-commerce sector to curb vehicular emission has boosted the industrial growth. Also, collaborations among government organizations and FCEVs companies to deploy hydrogen buses for interstate travelling purposes is contributing to the industry in a positive manner. Moreover, the increasing demand for long-range vehicles from the construction industry is expected to propel the growth of the hydrogen vehicle market.

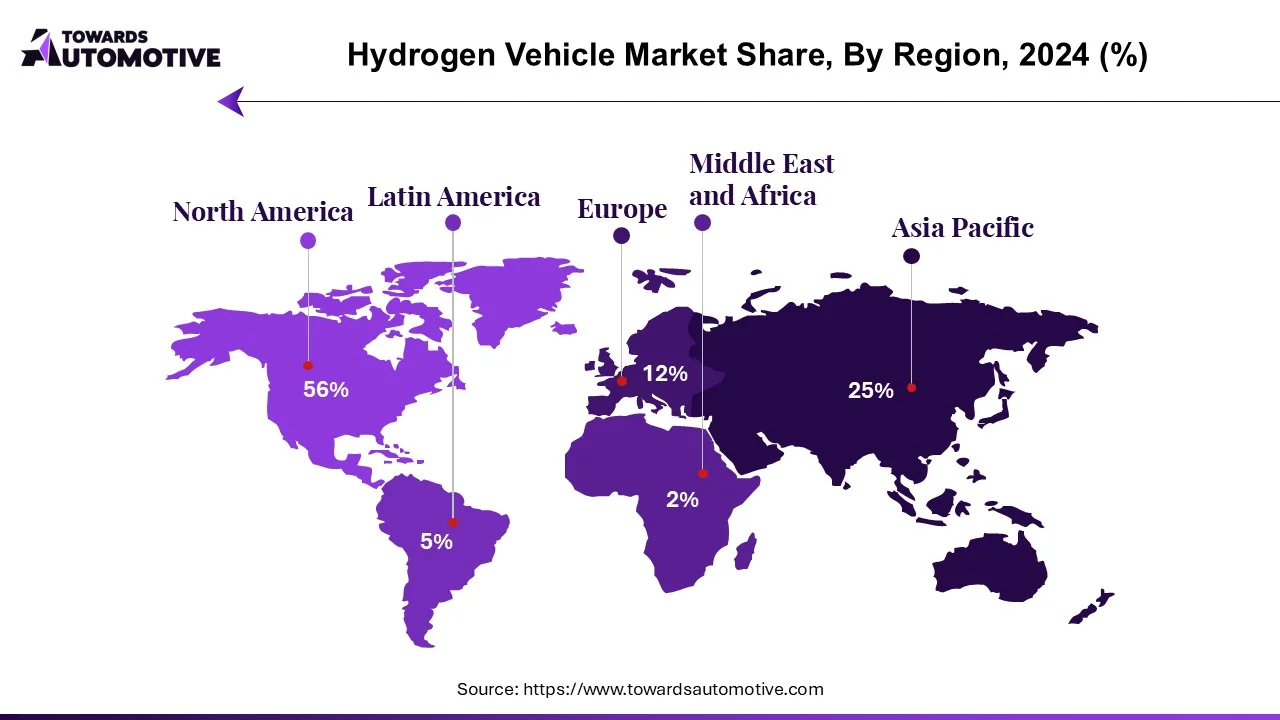

Asia Pacific led the hydrogen vehicle market. The growing adoption of hydrogen trucks in several sectors such as mining and construction for reducing vehicular emission has driven the market expansion. Additionally, numerous government initiatives aimed at developing the hydrogen infrastructure coupled with rising awareness of people to adopt FCEVs is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Toyota Motor Corporation, Honda Motor Corporation, Hyundai Motor Company and some others is expected to drive the growth of the hydrogen vehicle market in this region.

Europe is expected to grow with the fastest CAGR during the forecast period. The rising adoption of eco-friendly vehicles in several countries such as Germany, Italy, France, UK and some others has boosted the market growth. Also, rapid investment by government for opening new hydrogen refueling centers coupled with constant research and development activities related to FCEVs is significantly contributing to the industry. Moreover, the presence of various market players such as Mercedes Benz, Symbio, Hydrogen Vehicle Systems and some others is expected to boost the growth of the hydrogen vehicle market in this region.

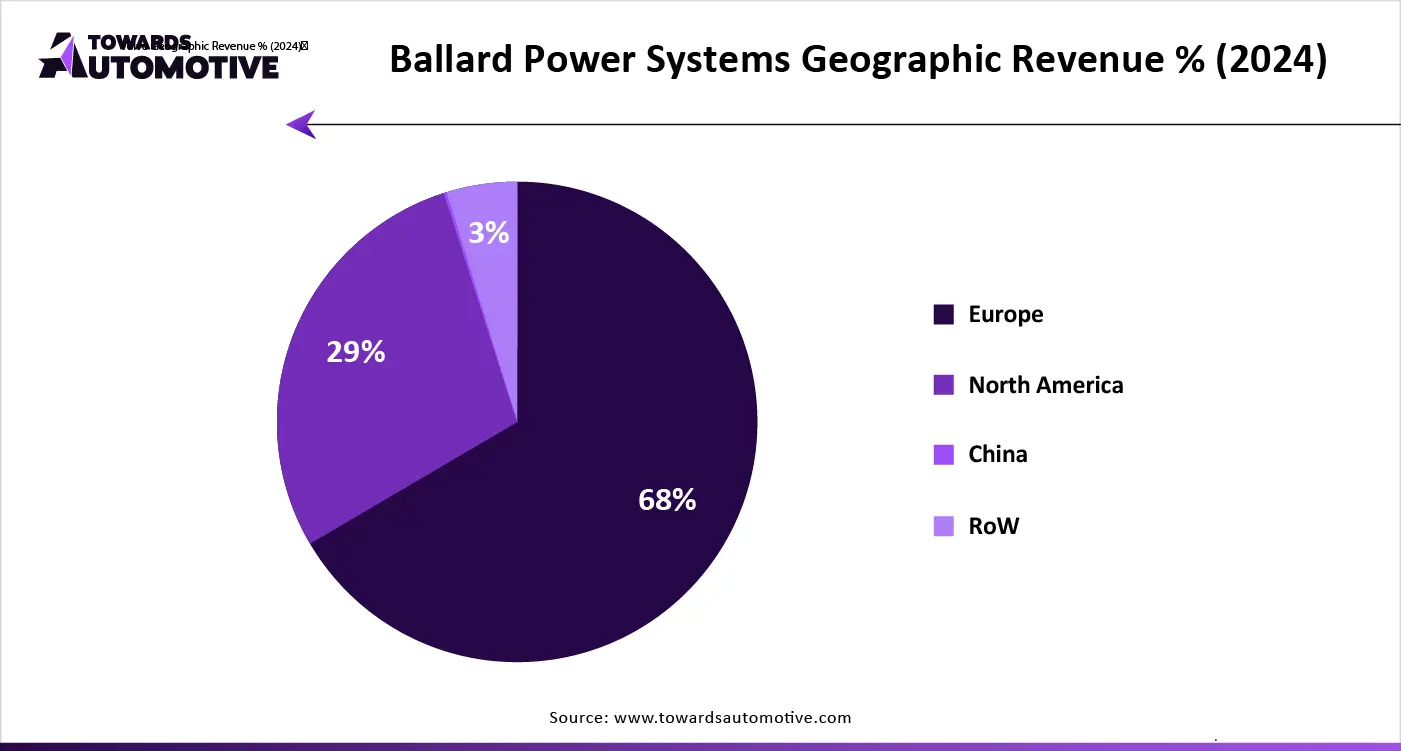

The hydrogen vehicle market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Nikola Corporation (U.S.)., Ballard Power Systems (Canada), Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor Co., Ltd. (Japan), Daimler AG (Mercedes-Benz) (Germany), General Motors Company (U.S.), BMW Group (Germany), Symbio (France), Hydrogen Vehicle Systems (U.K.) and some others. These companies are constantly engaged in developing hydrogen vehicles and adopting various strategies such as collaborations, product launches, partnerships, joint ventures, business expansion, acquisition, and some others to maintain their dominant position in this industry.

By Vehicle Type

By Technology

By Range

By Fuel Capacity

By Region

August 2025

August 2025

July 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us