September 2025

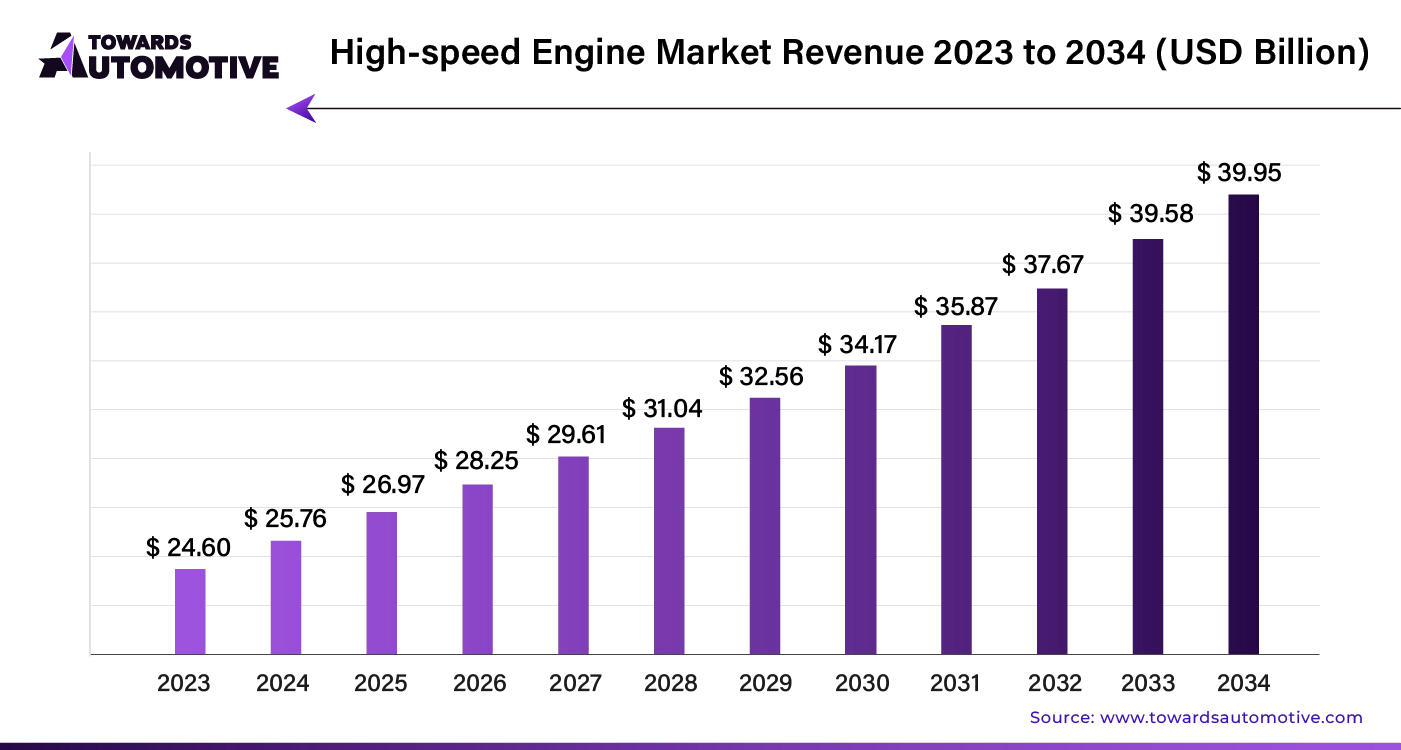

The high-speed engine market is forecast to grow from USD 26.97 billion in 2025 to USD 39.95 billion by 2034, driven by a CAGR of 4.83% from 2025 to 2034. The growing demand for advanced engines from the oil and gas industry coupled with technological advancements in the engine manufacturing sector has driven the market expansion.

Additionally, rapid investment by the railway sector to deploy high-speed engines in their trains to enhance passenger transportation along with numerous research and development activities performed by scientists to develop fuel-efficient high-speed engines is playing a vital role in shaping the industrial landscape. The increasing emphasis on developing emission-free engines is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The high-speed engine market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of high-speed engines in different parts of the world. These engines are designed for numerous end-users consisting of power generation, marine, oil and gas, railway and some others. It provides different speeds including 1,000 – 1,500 RPM, 1,500 – 1,800 RPM, above 1,800 RPM and some others. These engines deliver numerous power outputs comprising of 0.5-0.55, 0.56-1 MW, 1-2 MW, 2-4 MW, above 4 MW and some others. This market is expected to rise significantly with the growth of the marine sector around the globe.

The major trends in this market consists of partnerships, business expansions and popularity of electric engines.

The 1,000 – 1,500 RPM segment led the market. The growing demand for high-speed engines from the marine sector has driven the market expansion. Additionally, rapid investment by engine manufacturers to develop engines capable of running at 1,000 – 1,500 RPM speeds in the power generation industry is playing a vital role in shaping the industry in a positive way. Moreover, collaborations among engine makers and power generation sector to develop high-quality engines for generating electricity is expected to boost the growth of the high-speed engine market.

The 1,500 – 1,800 RPM segment is expected to grow with a considerable CAGR during the forecast period. The increasing demand for these engines in diesel generators for generating large amount of electric current for powering heavy machineries has driven the market expansion. Additionally, the rising application of diesel-powered engines in the marine sector for powering yachts coupled with its numerous applications in loaders and tractors is contributing to the industry in a positive manner. Moreover, rapid investment by engine manufacturers for opening up new manufacturing plants to enhance the production of 1,500 – 1,800 RPM engines is expected to drive the growth of the high-speed engine market.

The 1-2 MW segment dominated the market. The growing demand for these engines from the power generation sector has driven the market expansion. Additionally, the increasing use of these engines in generators to deliver power in several sectors including commercial properties, healthcare facilities, water treatment plants and some others is playing a vital role in shaping the industrial landscape. Moreover, partnership among engine manufacturers and power generation companies to develop powerful engines capable of generating power output of around 1-2 MW is expected to foster the growth of the high-speed engine market.

The 2-4 MW segment is expected rise with a notable CAGR during the forecast period. The growing demand for high-speed engines from the industrial equipment manufacturers has boosted the market expansion. Additionally, rapid investment by engine makers to develop 2-4 MW engines for the marine sector is playing a vital role in shaping the industrial landscape. Moreover, the increasing application of these engines in the railway sector is expected to propel the growth of the high-speed engine market.

The power generation segment held the largest share of the market. The increasing use of high-speed engines in power generation sector for producing electricity has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the power generation industry coupled with technological advancements in the electricity generation sector is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by engine manufacturers to develop a wide range of high-speed engines for generating maximum power is expected to boost the growth of the high-speed engine market.

The marine segment is expected to expand with a robust CAGR during the forecast period. The growing demand for high-quality electric engines to power modern vessels has driven the market growth. Also, rapid investment by government of several countries such as Germany, Spain, the U.S, India, China and some others for strengthening the water transportation sector coupled with rising focus of engine brands to manufacture high-speed engines for ships and boats is playing a crucial role in shaping the industry in a positive manner. Moreover, partnerships among shipbuilding companies and engine makers to develop emission-free engines is expected to drive the growth of the high-speed engine market.

Asia Pacific dominated the high-speed engine market. The growing demand for high-speed diesel engines in several countries such as India, China, Japan, South Korea and some others to cater the needs of several end-users has boosted the market expansion. Additionally, numerous government initiatives aimed at rising awareness about vehicular emission along with technological advancements in the engine manufacturing sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Doosan Infracore, Yanmar Holdings, Weichai Power and some others is expected to boost the growth of the high-speed engine market in this region.

China led the market in this region. In China, the market is generally driven by the growing demand for high-speed engines from the railway sector coupled with rapid investment by market players for opening new engine manufacturing plants. Moreover, the availability of skilled workforce along with abundance of essential raw materials is contributing to the industry in a positive manner.

North America is expected to grow with a significant CAGR during the forecast period. The growing demand for high-speed aerospace engines in the U.S. and Canada has driven the market expansion. Additionally, rapid investment by engine manufacturers for developing emission-free engines coupled with rise in number of startup companies dealing in marine sector is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as Caterpillar, Cummins, General Electric and some others is expected to propel the growth of the high-speed engine market in this region.

U.S. dominated the market in this region. The growing emphasis of aerospace sector to deploy electric engines in their aircrafts to lower emission coupled with rapid growth in the oil and gas industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of various engine manufacturers along with numerous government initiatives aimed at developing the power generation sector has driven the market growth.

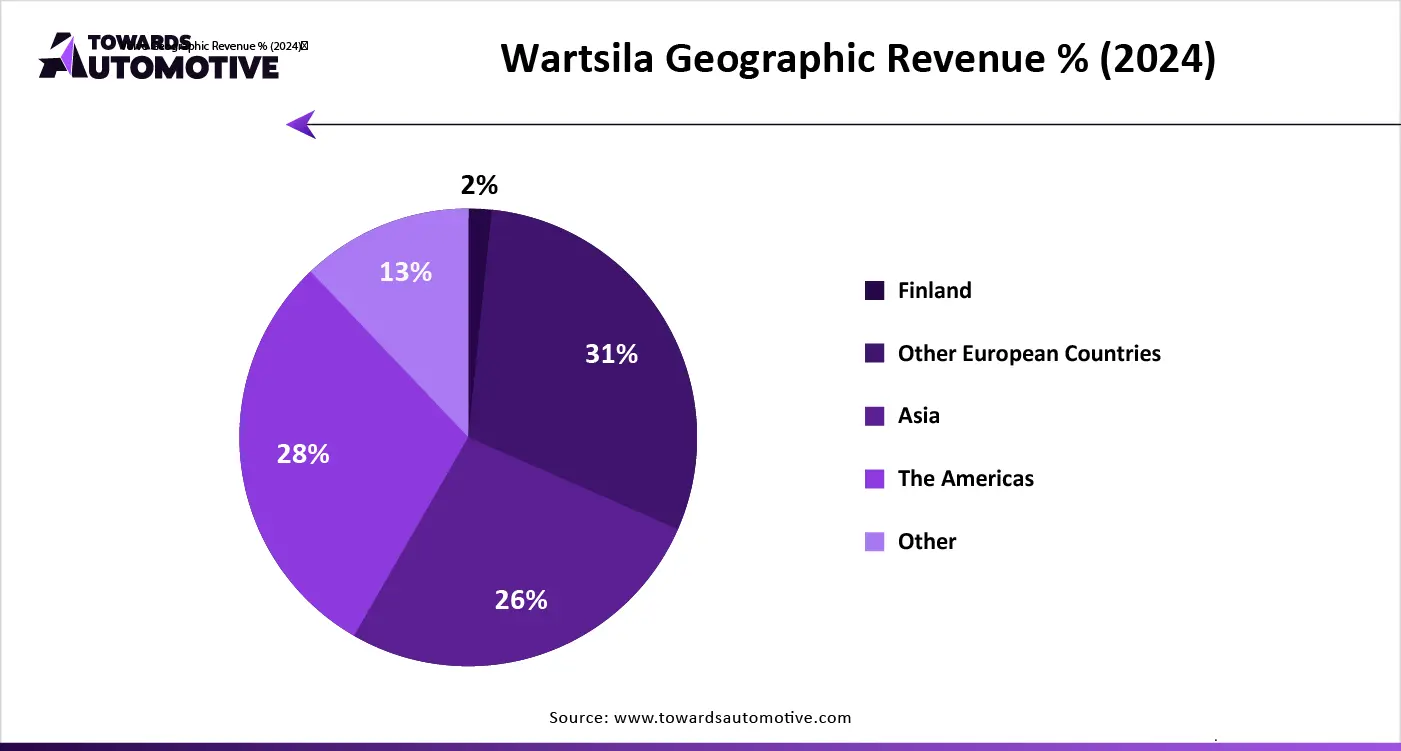

The high-speed engine market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of MAN SE (Germany), Weichai Power (China), Caterpillar (U.S.), Cummins (U.S.), Rolls Royce (U.K.), Volvo Penta (Sweden), Wartsila (Finland), Mitsubishi Heavy Industries (Japan), Doosan Infracore (South Korea), Yanmar Holdings (Japan), Kohler (U.S.) and some others. These companies are constantly engaged in developing high-speed engines and adopting numerous strategies such as partnerships, business expansions, acquisitions, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

By Speed

By Power Output

By End-User

By Region

September 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us